Facts About Multi Peril Crop Insurance Revealed

Wiki Article

The Single Strategy To Use For Multi Peril Crop Insurance

Table of ContentsThe Ultimate Guide To Multi Peril Crop InsuranceEverything about Multi Peril Crop InsuranceMulti Peril Crop Insurance - An OverviewThe 15-Second Trick For Multi Peril Crop Insurance3 Easy Facts About Multi Peril Crop Insurance Explained

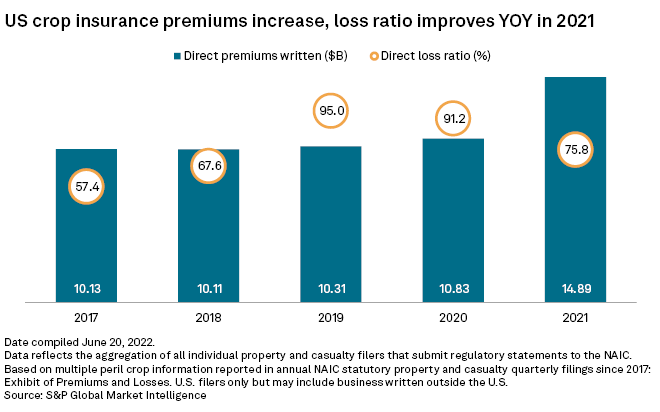

The crop insurance plan under FCIP are understood are multiple-peril farming insurance plan as well as are based upon yield or profits. Not all plants are insured by these plans. While the federal-government problems see relating to the plants to be insured for every various other, one of the most frequently guaranteed plants include corn, cotton, soybeans, as well as wheat while several other crops may be insured where they are located more typically.

It is comparative with this referral and by utilizing the federal government market rate of the plants that claims can be made and protection is dispersed. It deserves keeping in mind that farmers need to acquire multiple-peril insurance policy policies before growing the crops before the deadline or the sales closing date (SCD).

How Multi Peril Crop Insurance can Save You Time, Stress, and Money.

Different from the FCIP Insurance plan, Crop hail storm insurance policy is not connected with the government as well as is entirely marketed by personal business that can be purchased whenever during the plant cycle. Hail storm protection, unlike the name suggests, covers plants from threats other than hail storm like fire, lightning, wind, criminal damage, and so on.When participating in the contract with the insurance firms, farmers select the volume of the return to be guaranteed (which could be in between (50-85)% depending upon demands) as well as the protection rates of the federal government. While MPCI utilizes the reference yield acquired from the historical information of the farmers to figure out the loss, Group-Risk-Plan (GRP) utilizes a region yield index.

Given that these computations can take time, the moment of repayment upon insurance claims can take even more time than MPCI repayments. Revenue Insurance policies, on the various other hand, offer protection against a decrement in generated profits which could be a result of loss of production along with the adjustment out there price of the crops, or perhaps both.

Fascination About Multi Peril Crop Insurance

This type of plan is based on providing defense if and also when the typical county revenue under insurance drops below the profits that is chosen by the farmer. Crop insurance coverages are essential to the financial sustainability of any type of farmland. The standard concept of farming insurance is as basic as it is essential to understand, selecting the ideal type of insurance that suits your particular demands from a myriad of insurance policy plans can be a challenging job.It's vital to note that coverage for drought may have particular constraints or demands. For instance, the policy could have specific requirements relating to the seriousness and period of the dry spell, as well as the influence on plant manufacturing. Farmers must very carefully evaluate their insurance coverage as well as speak with their insurance coverage representative to comprehend the extent of protection for drought and also any other weather-related threats.

Mark the damaged area locations after a weather catastrophe or a condition or a pest assault and also send out records to the insurance policy.

Multi Peril Crop Insurance Things To Know Before You Buy

For a detailed summary of precise coverages, restrictions as well as exemptions, please refer to the plan.

Fantastic point. As well as there's a few other points that should think about points like the farm machinery as well as the equipment, just how much insurance coverage you require for that? Just how much is it worth? What are a few other points to take into consideration right here in our last couple of minutes, some various other points to assume about besides just these leading 5? One of the important things that I consider a whole lot is your automobiles.

Our Multi Peril Crop Insurance Diaries

Or if you do relocate to a farm automobile plan, typically on a farm car policy, your obligation will begin higher. One of the reasons that we consider that as well, and why we create the greater restrictions is due to the fact that you're not just utilizing that vehicle or you may not simply have that lorry individually, however if you are a farmer as well as that is your income, having something that can return to you, that you are responsible for, having those higher restrictions will not just secure you as as a private, however will certainly aid secure that ranch too.

That can go on the home owner's plan. Yet when your farm machinery is used for more than simply maintaining your residential or commercial property, then you really do intend to add that type of equipment to a farm look here policy or you intend to seek to obtaining a ranch policy. I have farmers that guarantee points from tractors to the watering devices, hay rakes, integrate, a lot of various points that can be covered independently.

Report this wiki page